For landlords and property managers, keeping accurate and organized financial records is crucial for the success of their rental property businesses. Proper bookkeeping not only helps in tracking income and expenses but also ensures compliance with tax regulations and provides valuable insights into the financial health of the properties. In this article, we will explore the best practices for rental property bookkeeping that can help landlords streamline their financial management processes and make informed decisions.

Establish a Separate Bank Account for Rental Properties

One of the fundamental principles of effective rental property bookkeeping is to maintain a separate bank account for each rental property. Mixing personal and rental property finances can lead to confusion and make it challenging to track income and expenses accurately. By keeping individual bank accounts for each property, landlords can easily monitor cash flow, identify tax-deductible expenses, and simplify financial reporting.

Use Accounting Software for Efficient Record-Keeping

In today’s digital age, manual bookkeeping processes are becoming obsolete. Utilizing accounting software designed for rental property management can streamline financial record-keeping and improve overall efficiency. These software solutions offer features such as income and expense tracking, automated rent collection, financial reporting, and integration with bank accounts, making it easier for landlords to manage their rental properties’ finances effectively.

Regularly Reconcile Accounts and Track Expenses

Reconciling bank statements with accounting records on a monthly basis is essential for ensuring accuracy and identifying any discrepancies promptly. This process helps landlords identify missing transactions, bank errors, or unauthorized charges, allowing them to rectify the issues before they escalate. Additionally, tracking expenses diligently, including maintenance costs, repairs, property management fees, and utilities, provides a comprehensive overview of the property’s financial performance and helps in budgeting for future expenses.

Maintain Detailed Records of Income and Expenses

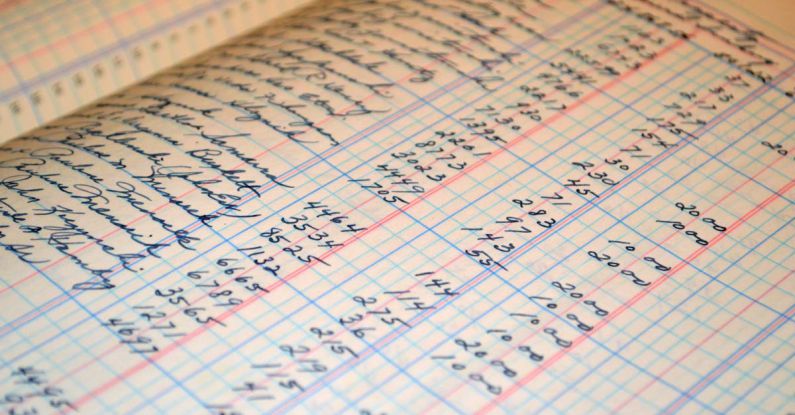

Keeping detailed records of all income and expenses related to rental properties is vital for proper bookkeeping. This includes documenting rental payments, security deposits, late fees, maintenance costs, property taxes, insurance premiums, and any other financial transactions associated with the property. Maintaining organized records not only simplifies tax preparation but also provides valuable insights into the profitability of the rental properties and helps in making informed financial decisions.

Implement a System for Rent Collection and Late Payments

Establishing a systematic approach to rent collection is essential for maintaining steady cash flow and minimizing late payments. Setting clear rent payment deadlines, providing multiple payment options for tenants, and sending timely reminders can help landlords ensure on-time rent collection. In cases of late payments, it is crucial to follow up promptly with tenants, enforce late fees as per the lease agreement, and document all communication related to rent payments for future reference.

Monitor and Adjust Budgets Regularly

Creating a budget for each rental property and monitoring actual expenses against the budgeted amounts is key to financial planning and control. By comparing budgeted costs with actual expenditures, landlords can identify areas of overspending, implement cost-saving measures, and adjust future budgets accordingly. Regular budget reviews help in maintaining financial discipline, optimizing cash flow, and maximizing the profitability of rental properties.

Utilize Professional Accounting Services When Needed

While landlords can handle basic bookkeeping tasks themselves, seeking professional accounting services can be beneficial, especially for complex financial transactions or tax-related matters. Hiring an accountant or a bookkeeper with experience in rental property management can ensure compliance with tax laws, provide expert financial advice, and offer strategic insights into optimizing the financial performance of rental properties. Professional accounting services can also save time and reduce the stress associated with managing financial records independently.

Incorporate these best practices into your rental property bookkeeping processes to enhance financial transparency, streamline operations, and make informed decisions that drive the success of your rental property business. By maintaining accurate and organized financial records, landlords can effectively track income and expenses, optimize cash flow, and maximize profitability, ultimately leading to long-term success in the competitive rental property market.